I, for one, am totally psyched to re-open the Title II / Net Neutrality debates. I’ve been looking for an excuse to re-read the first piece I wrote about it, in 2006 (with Bob Hahn), and now I have one! Even better, the deadlines for comments and reply comments neatly bracket the winter holidays. It’s a Festivus miracle!

But let’s not get ahead of ourselves.

On September 26 at the National Press Club, FCC Chairwoman Jessica Rosenworcel laid out her arguments for reclassification. Among them was a claim that the lack of broadband competition makes Title II necessary.

One can make coherent and serious arguments supporting Title II and net neutrality. But Title II because of the state of competition? No.

The Press Club talk used some fancy footwork to support the claim about competition:

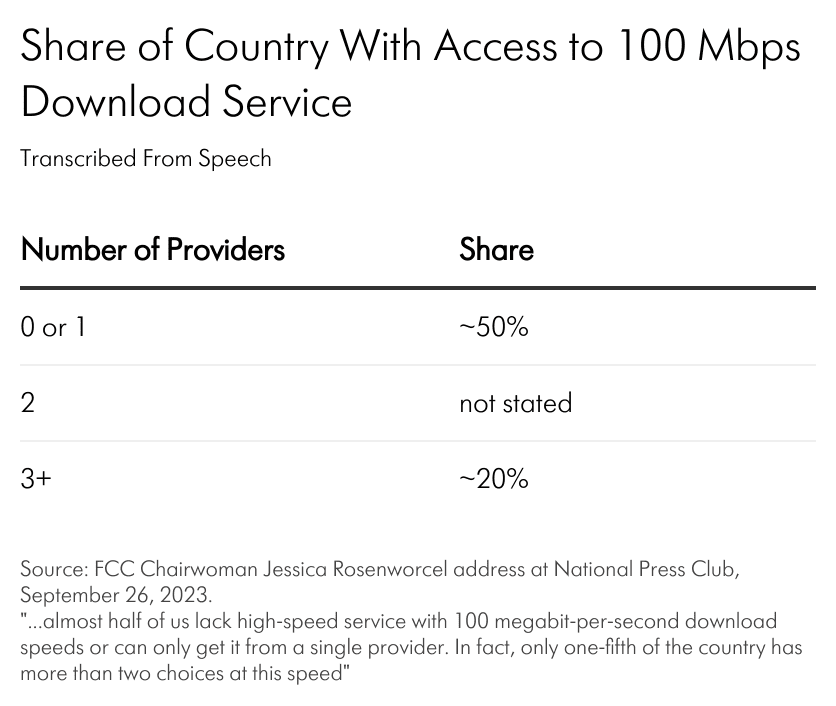

...almost half of us lack high-speed service with 100 megabit-per-second download speeds or can only get it from a single provider. In fact, only one-fifth of the country has more than two choices at this speed. So if your broadband provider mucks up your traffic, messing around with your ability to go where you want and do what you want online, you can’t just pick up and choose another provider. That provider may be the only game in town. You need a referee on the field looking out for the public interest—and ensuring your access is fast, open, and fair. On issue after issue, reclassifying broadband as a Title II service would help the FCC serve the public interest more efficiently and effectively.

Let’s break this down.

The table below shows the numbers as provided in the speech:

The implication is that Title II is necessary to protect consumers who can access no or only one provider. In order to believe that Title II would help areas with no access, one must also believe that it will create incentives to invest in those areas. You can’t regulate something that doesn’t exist.

To believe that the presence of people with access to only one provider justifies Title II then one must believe that those areas will continue to have only one provider or that competition will not improve without Title II.

Let’s take a deeper look at the data on competition using data from the FCC’s new map.

The speech provides only the download speed (100 Mbps) and not the upload speed. Let’s assume the Chairwoman meant 100/20, as that’s the generally accepted definition of fully served locations. The table below shows the share of locations with a given number of non-satellite (more on that later) providers offering at least 100/20 in December 2022.

The share of locations with zero or one providers is about 45.3 percent, while 17.9 percent have three or more, which are reasonably close to “about 50 percent” and “one-fifth” respectively.[1] Left out of the speech is that nearly 55 percent have two or more providers.

Additionally, broadband is not a have/don’t have service. It varies across many attributes, and it is not the case that if your download speed dips below 100 Mbps you suddenly do not have broadband. The FCC acknowledges that by providing information on different tiers and by weighing attributes differently in some of its subsidy programs. Not surprisingly, the data show more competition at the 25/3 tier (considered “underserved” in BEAD).

The figures below show the full distributions of the number of providers at the two speed tiers.

Increasing Competition

The Chairwoman is right that areas actually served by only one provider and likely to continue to be served by only one provider really do require more oversight than areas with more competition. But clear trends over time showing increased competition plus the arrival of new facilities-based competition blanketing the country suggest increasingly smaller shares of people live in such areas.

More Competition for Higher-Quality Service Over Time

The data discussed above show a snapshot of about a year ago. Over time, the data show a steady increase in the share of households with multiple non-satellite broadband providers at all speed tiers. The data are imperfect. The FCC’s Form 477 data, which is the source of the data through 2021, has many well-known problems, but there is no reason to think those problems affect trendlines in any consistent way.[2]

A New Era in Facilities-Based Competition

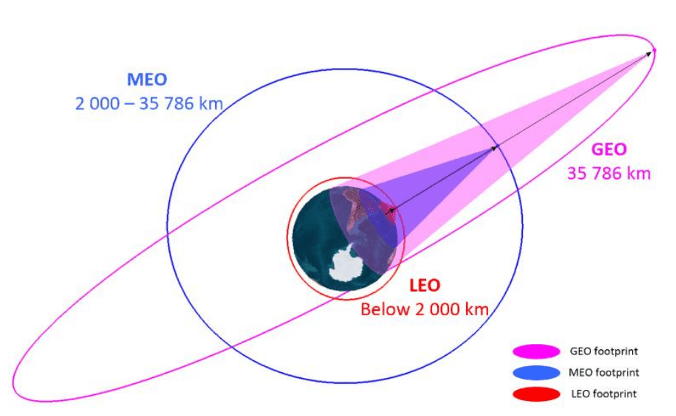

All of the numbers discussed above understate locations with access because they ignore competition from low-earth orbit (LEO) satellite.

The FCC excludes satellite from its discussions of competition, and most subsidy programs also exclude satellite. Two companies, Viasat and Hughes, offer service across the entire country that meets the FCC’s definition of broadband but whose service, due to their geostationary orbit, has much higher latency than terrestrial options.

LEO satellites have no such latency because they are so much closer to the Earth. To cover large geographic areas, networks built on this technology require constellations of thousands of satellites.

Currently one LEO network (Starlink by SpaceX) provides service, with nearly 4,700 operational satellites. By the end of 2022 Starlink reported 1 million subscribers and 2 million by September 2023, although it is unclear how many of those were in the U.S.

Meanwhile, other LEO networks are racing to compete. Amazon’s Project Kuiper recently launched its first prototype satellite and has permission to place 3,200 satellites in orbit. The EU, meanwhile, is planning its own competing LEO constellation network, Iris2. It has not said anything about offering service in the U.S., but just as Starlink provides service globally, presumably Iris2 could, as well. Another company, OneWeb, has more than 630 satellites in orbit and currently offers more of an internet-of-things network, although might offer home broadband in the future.

While fixed wireless networks have provided service to many for years, 5G fixed wireless is increasingly ubiquitous. T-Mobile, AT&T, and Verizon all have 5G fixed wireless networks competing with wired networks. To be fair, it can be difficult to know which locations receive strong enough signals to get their full benefits. Still, according to a report by T-Mobile, between Q4 2021 and Q3 2022 2.6 million of the 3.3 million net new broadband adds was fixed wireless .

Not to be outdone, cable is pushing out its “10G” investments and telcos continue rolling out fiber.

All of this is happening in a world without regulating broadband under Title II.

I’m not saying the lack of Title II was THE reason for more competition—I’d put my money on technological improvements –but the evidence just doesn’t support a T2-competition connection.

Perhaps this sea-change would have happened even with Title II. It’s impossible to know the counterfactual, although most research has found that Title II-style regulation has been bad for investment and innovation not just in telecommunications, but in other areas like railroads and gas, as well.

As I wrote in 2015 when we last had this debate,

Even when established with the best of intentions, however, regulations do not necessarily work for the public good. Instead, they become the product of lobbying by interested parties ranging from companies to public interest groups to Congress and others over how to distribute profits. The interactions between the regulator and those parties inevitably lead to increasingly complex and politicized regulatory regimes. There’s no reason to believe it will be any different this time.In short, the data on current broadband availability, recent trends, and emerging new competitors, all suggest that competition supports maintaining the status quo rather than supporting Title II.

[1] To the Chairwoman’s credit, she rounded up the number that supports her point as well as the one that would counter her point.

[2] Tangentially, comparing the 100/20 table above with the December 2022 numbers in the figure highlights how the FCC’s new data collection and reporting mechanism affects our view of the market. As shown in the table above, about 55 percent of locations have access to two or more providers. The figure, however, shows 100/20 at 76 percent. The reason for this difference is that to create the time series we took the new data and estimated the number based on 477 methodology to make the time series consistent. Again, that means the levels in the series may be off, but the trends should not be.

Scott Wallsten is President and Senior Fellow at the Technology Policy Institute and also a senior fellow at the Georgetown Center for Business and Public Policy. He is an economist with expertise in industrial organization and public policy, and his research focuses on competition, regulation, telecommunications, the economics of digitization, and technology policy. He was the economics director for the FCC's National Broadband Plan and has been a lecturer in Stanford University’s public policy program, director of communications policy studies and senior fellow at the Progress & Freedom Foundation, a senior fellow at the AEI – Brookings Joint Center for Regulatory Studies and a resident scholar at the American Enterprise Institute, an economist at The World Bank, a scholar at the Stanford Institute for Economic Policy Research, and a staff economist at the U.S. President’s Council of Economic Advisers. He holds a PhD in economics from Stanford University.