After Stage 4 of the incentive auction, broadcasters asked for $10 billion to clear 84 MHz of spectrum—down from $86 billion to clear 126 MHz in Stage 1. Assuming that wireless providers will bid enough to allow the auction to close, FierceWireless noted, “that would bring a disappointing end to an auction that once was predicted to generate $60 billion or more…”[1] Disappointment, however, is all a matter of expectations, and expectations for this auction had become unrealistic by the time it began last year.

In reality, spectrum bids in the forward auction have been approximately in line with prices and expectations prior to the 2015 AWS-3 auction, which yielded prices more than twice what analysts had expected. However, the auction itself raises other questions. It took about six years from the time the National Broadband Plan put the idea back into the policy milieu to the auction’s kickoff,[2] and it will be more years still before the spectrum is usable by auction’s winners. As part of the incentive auction’s postmortem, we should consider whether other options, like auctioning “overlay” rights or allowing broadcast licenses to support any wireless service, might have yielded similar or better outcomes in less time.

The 2015 AWS-3 Auction Created Unrealistic Expectations

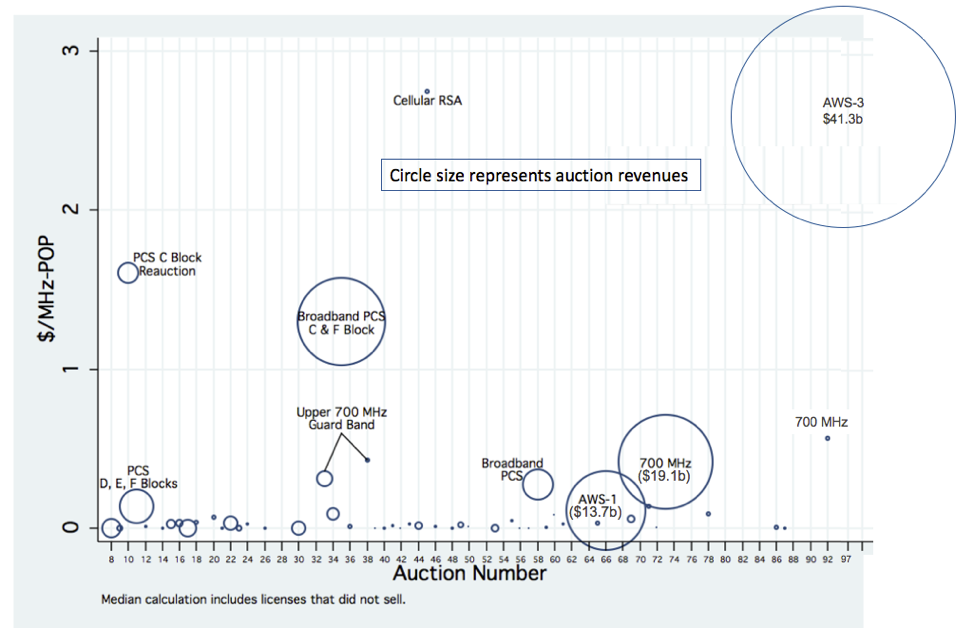

A key reason some view the incentive auction results as disappointing is the recently completed 2015 AWS-3 spectrum auction, which resulted in prices far above expectations. Specifically, the AWS-3 auction yielded an average of $2.72 per MHz-pop for paired spectrum, when analysts had expected prices of about $1.00 per MHz-pop.[3] This generated more than $44 billion for the U.S. Treasury.[4] Figure 1 shows that AWS-3 appears to have been an outlier.

Figure 1: FCC Spectrum Auction Results Through AWS-3

Source: Wallsten (2016) and FCC.[5]

Following that bonanza, broadcasters and federal budget watchers saw big, Krusty Krab-style, dollar signs in their eyes. If buyers were willing to pay amounts similar to what they paid for AWS-3, some analysts estimated revenues from the incentive auction as high as $70 – $80 billion.[6] Such was the hype that one article characterized JP Morgan’s estimate as “only” $25-$35 billion.[7] To many, spectrum had become the goose that laid the golden egg.

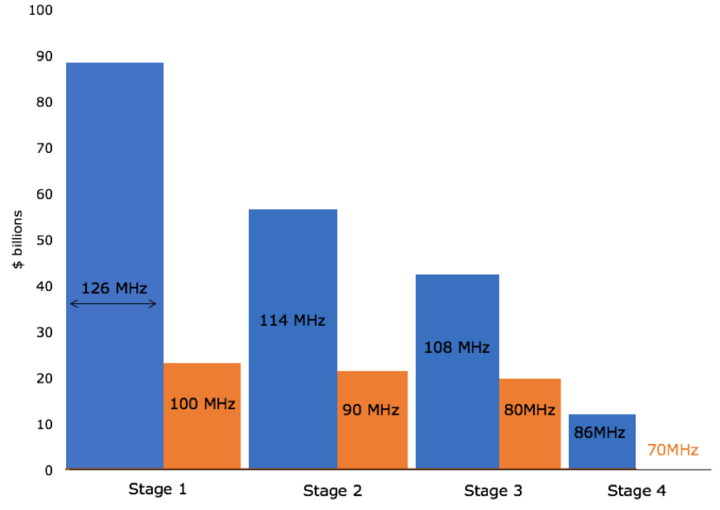

The gold began to look a little more like brass in the first stage of the incentive auction, when broadcasters asked for $86.4 billion to clear 124 MHz of spectrum while wireless providers bid only $23 billion. As planned, the FCC then reduced the clearing target and broadcasters began exiting the auction. At the end of the third stage, broadcasters asked for around $40 billion to clear 108 MHz of spectrum, and wireless providers bid about $20 billion for the 70 MHz of usable spectrum that would become available. Finally, in stage 4, broadcaster bids to exit the market tumbled to about $10 billion to clear 84 MHz of spectrum. The auction seems likely to close after this stage assuming wireless providers bid the minimum of $1.25 average for the top 40 markets. If not, it will continue to stage 5.

Figure 2: Incentive Auction Results

Source: FCC, various publications.

So the incentive auction didn’t lay a golden egg. The Goose Who Laid the Golden Eggs is just a fairy tale, after all. But the auction laid a regular egg, and regular eggs have real benefits.[8] Just because the incentive auction didn’t match the windfall of AWS-3 does not mean it should be considered a failure.

Auctions Are Intended to Generate Market Information

To some extent, disappointment also follows from a fundamental misunderstanding of why we use auctions. They are not supposed to maximize revenues. They are not even necessarily supposed to maximize the amount of spectrum reallocated. Instead, they are a mechanism that creates a market and market-based information where those things did not previously exist.

The incentive auction, in particular, is intended to reveal the market value of spectrum currently allowed only for television broadcast and, based on that information, ensure that the spectrum is allocated to those who value it the most. This auction tells us that broadcasters value 86 MHz of broadcast spectrum at about $10 billion, or less than $0.50 per MHz-pop on average. So far, wireless providers have valued this spectrum fairly consistently at about $0.85-$0.90 per MHz-pop on average.[9]

The FCC Deserves Accolades for Making This Auction Work

Regardless of the ultimate results of the auction, we can still deem the mechanics of the auction itself as a success. The auction design and the software built to run the auction are both complex. They have to accommodate a reverse auction to reveal the amount television broadcasters must be paid in different markets to stop broadcasting, a mechanism that determines how to “repack” the stations remaining on the air in a way that clears the largest contiguous blocks of spectrum for use by wireless services, and a forward auction where wireless providers bid for exclusive rights to use spectrum in those blocks. Of those three components, we have significant experience only with the forward auction. The other two, while not entirely new if viewed in other contexts such as procurement auctions and previous spectrum repacking exercises, are far more complex than any done before, and it has never been necessary to coordinate all three.

Given its complexity and novelty, it is fair to say that the mechanisms of the auction appear to be successful. In an era when government is (rightly) criticized for high-profile technology failures like dysfunctional health care enrollment websites and inability to secure the personal information of tens of millions of federal workers, the FCC staff deserves high praise for making this complex system work. This is not a small accomplishment.

Was the Auction the Right Approach in the First Place?

A crucial remaining question is whether the incentive auction was the right approach.

Two other approaches were possible.

The first possibility would be auctioning off “overlay” licenses, in which bidders vie for spectrum in a given geographic area and spectrum band as well as the right to negotiate with any incumbent operators in that band.[10] In the case of broadcasters, the FCC would have auctioned off 600 MHz licenses and then left it to the auction winners to negotiate with the relevant broadcasters.

The second possibility would be making licenses that currently allow only television broadcast to be used more broadly, including for wireless services. Wireless service providers could then conduct private market transactions with broadcasters for the licenses without needing much, if any, government intervention.

The counterargument to both was that the transactions costs of assembling the right combination of licenses to create a meaningful geographic footprint within any given spectrum band were too high. The transactions cost argument is sensible. Any wireless provider would have faced a daunting task in creating a viable 600 MHz spectrum footprint. However, the direct costs of the auction and, more importantly, the opportunity costs of a six-year (and counting) delay are not insignificant. This should be considered going forward.

Going Forward: Flexible Use, Tradable Spectrum Licenses

A positive price for spectrum—even if that price is not as high as many hoped—demonstrates that it remains a valuable commodity. Policymakers should continue to ensure that spectrum be deployed for high-value applications. A good next step would be eliminating remaining usage restrictions on spectrum. Television broadcast spectrum can be used only for that purpose because the licenses say so. It should be possible to use it—and spectrum covered by other licenses—for any purpose, subject to interference constraints, and to buy and sell those licenses freely.[11]

At the end of the day, the auction will have generated real benefits by transferring some spectrum from broadcasters to others who value it more highly. It also further demonstrates the FCC’s ability to conduct reverse auctions, which could be employed for other purposes. The lower-than-recently-expected revenues bears little relationship to whether the auction should be called a success. But the long time-frame from proposal to auction creates costs by keeping that spectrum otherwise tied up. It is time for the FCC to consider overlay auctions and other property rights-based options for ensuring spectrum is deployed in ways that create the most benefits.

[1] http://www.fiercewireless.com/wireless/clearing-cost-plummets-for-stage-4-fcc-s-incentive-auction

[2] Evan Kwerel and John Williams proposed the idea even earlier. Evan Kwerel and John Williams, “A Proposal for a Rapid Transition to Market Allocation of Spectrum,” FCC OPP Working Paper Series, 2002, http://wireless.fcc.gov/auctions/conferences/combin2003/papers/masterevanjohn.pdf.

[3] http://www.fiercewireless.com/special-report/aws-3-spectrum-auction-primer-what-you-need-to-know-before-bidding-starts

[4] Peter Cramton, “Bidding and Prices in the AWS-3 Auction” May 2015, http://www.cramton.umd.edu/papers2015-2019/cramton-aws-3-auction-prices.pdf.

[5] Scott Wallsten, “Is There Really a Spectrum Crisis? Disentangling the Regulatory, Physical, and Technological Factors Affecting Spectrum License Value,” Information Economics and Policy 35 (June 2016): 7–29, doi:10.1016/j.infoecopol.2016.01.001.

[6] http://www.fiercewireless.com/wireless/j-p-morgan-fcc-s-600-mhz-incentive-auction-likely-to-fetch-only-25b-to-35b

[7] http://www.fiercewireless.com/wireless/j-p-morgan-fcc-s-600-mhz-incentive-auction-likely-to-fetch-only-25b-to-35b

[8] In fact, America’s egg farmers would like us to know that gymnast Shawn Johnson said, “I literally can’t start my day without eggs .…Eggs are packed with high-quality protein and are a nutritional powerhouse….” http://www.incredibleegg.org/wp-content/uploads/Shawn-Johnson-Industry-Release-FINAL.pdf

[9] As estimated by Craig Moffett (2017).

[10] Hazlett, Thomas W., “Optimal Abolition of FCC Allocation of Radio Spectrum,” Journal of Economic Perspectives 22 (Winter 2008).

[11] The FCC has previously said that it would not grant such rights in order to help convince broadcasters to participate in the incentive auction. While reneging on such a promise would not be good for the FCC’s credibility, it should balance that cost with the potential benefits of creating more flexible-use licenses.

Scott Wallsten is President and Senior Fellow at the Technology Policy Institute and also a senior fellow at the Georgetown Center for Business and Public Policy. He is an economist with expertise in industrial organization and public policy, and his research focuses on competition, regulation, telecommunications, the economics of digitization, and technology policy. He was the economics director for the FCC's National Broadband Plan and has been a lecturer in Stanford University’s public policy program, director of communications policy studies and senior fellow at the Progress & Freedom Foundation, a senior fellow at the AEI – Brookings Joint Center for Regulatory Studies and a resident scholar at the American Enterprise Institute, an economist at The World Bank, a scholar at the Stanford Institute for Economic Policy Research, and a staff economist at the U.S. President’s Council of Economic Advisers. He holds a PhD in economics from Stanford University.