Data privacy is a big issue. Europe’s GDPR and California’s CCPA are perhaps the two best-known privacy laws, but the list of jurisdictions with or considering privacy rules is growing fast. Governments give a variety of reasons for enacting such laws, but one key question is what citizens themselves want.

Recently, we embarked on one of the most expansive endeavors to measure privacy preferences to date, collecting measures for thousands of people across six countries. A full discussion of our analyses is in a recently published article. However, in our experience discussing our results at conferences, we have found that our consistent findings across countries regarding basic demographic groups always receive the most interest for the conventional wisdoms that they do and do not confirm.

In short, we find that around the world,

- Women tend to value data privacy more than men;

- Older people value data privacy far more than younger people; and

- Lower-income and higher-income people tend to value privacy similarly.

Research Method

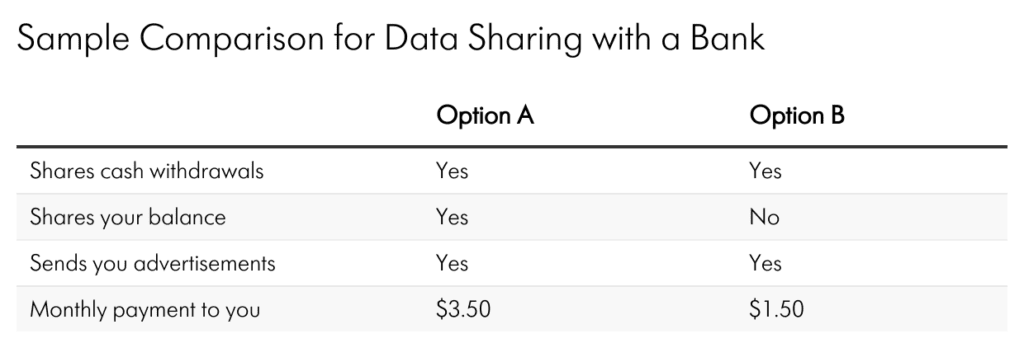

We collected and analyzed data from four separate surveys we designed that employ repeated discrete choice experiments (DCEs). The surveys pertain to respondents’ wireless carrier, Facebook use, checking account at a bank, and smartphone. Each survey asks respondents to make choices among data sharing options that vary according to which data are shared and monthly payments that the respondents would receive. For example, a respondent may be asked to compare the following two options in terms of data sharing (and advertising) with their bank:

Here, sharing of a data type means sharing with third parties. DCE choices like these mimic typical choices in the marketplace (comparisons of features and payments) and have been shown to be capable of eliciting respondents’ tradeoffs. Importantly, unlike more common surveys that people are familiar with, they never directly ask about the issue in question, making it more difficult for respondents to “game” the survey or provide answers that do not match their actual preferences.

To see how it works, consider our example. Choosing Option A implies a monthly payment of $2.00 more than Option B is enough for the respondent to be willing to share bank balance information, whereas choosing Option B implies the $2.00 monthly payment is not enough. By observing many choices with many combinations of data sharing, advertising and payment features, the researcher can pin down privacy preferences quite precisely.

We administered tens of thousands of such (optimally constructed) choices to thousands of respondents across six countries (United States, Mexico, Germany, Colombia, Argentina, and Brazil). The choices made by our respondents allow us to determine what are the data types they want kept private the most, and we can also determine relative preferences for privacy for each data type across demographic groups. The charts below show the average willingness-to-accept for each data type across multiple demographic cuts of our data. The relative size of the bars indicates the relative strength of privacy preferences for each data type.

Privacy Valuation by Demographics (Monthly WTA)

The figures show that women value privacy around twice as much as men. People over 45 value privacy about four times as much as those under 45. However, for income, we see no consistent difference. The only data type where a difference in privacy value by income even appears mildly apparent concerns the sharing of one’s bank balance – a data type where income, per se, plausibly impacts the value of its privacy.

The comparisons in the figure are averaged across all six surveys. However, they generally hold even if one looks at each country individually. Hence, this appears to be a pattern that persists across many international borders. In a recent working paper looking at another group of seven countries (the only overlap being the U.S.), we again find this general pattern.

What can we do with such findings? If just taken at face value, we can see where support – and opposition – to privacy protection measures are likely to lie in the populus. Understanding variation in preferences can also help guide a two-way dialogue. Are those who place less value on privacy more attuned to benefits from the sharing and utilization of their data? Or are they less aware of the risks that come with their data being “out in the wild?” Are there characteristics related to age and sex, but not income, that drive one’s privacy preferences?

Taking steps toward understanding and addressing privacy preferences is important for good policy. To the extent that the public are not fully informed of risks and benefits of data sharing, there can be benefits from engagement by knowledgeable experts. On the flip side, experts and policymakers may also benefit from tools and analyses designed to gather and summarize the diffuse “wisdom of the crowd.” Studies like ours can help experts understand where their expertise may be best shared and also where there may be gaps in their understanding.

Jeff Prince is Professor of Business Economics and Public Policy at the Kelley School of Business, Indiana University. He is also the Harold A. Poling Chair in Strategic Management. His specialized fields of research include industrial organization, applied econometrics, strategy, and regulation. He served as Chief Economist at the Federal Communications Commission during 2019 and 2020. At the FCC, he advised the Commission on economic policy, auction design, data analytics, and antitrust matters.

Professor Prince has been recognized for excellence in both his research and his teaching during his time at the Kelley School and while at Cornell. He is an author of multiple textbooks covering a range of core microeconomic and econometric principles in managerial economics and predictive analytics. His research focus is on technology markets and telecommunications, having published works on dynamic demand for computers, Internet adoption and usage, the inception of online/offline product competition, telecom bundling, the valuation of product features, digital platforms, and data privacy. His research also encompasses topics such as household-level risk aversion, airline quality competition, and regulation in healthcare and real estate markets. His works have appeared in top general interest journals in both economics and management, including the American Economic Review, the International Economic Review, Management Science, and the Academy of Management Journal. He has also published in top journals in industrial organization, including the Journal of Industrial Economics, Journal of Economics and Management Strategy, and the International Journal of Industrial Organization. He is currently a co-editor at the Journal of Economics and Management Strategy, and is on the board of editors at Information Economics and Policy.

Professor Prince has consulted for various clients on valuing antitrust, intellectual property, damages, and data privacy concerns. As part of this work, he has written numerous expert reports and provided oral expert testimony, through both deposition and trial, on many occasions.

Professor Prince received his BS in mathematics and statistics and BA in economics from Miami University in 1998 and his PhD in economics from Northwestern University in 2004.

Scott Wallsten is President and Senior Fellow at the Technology Policy Institute and also a senior fellow at the Georgetown Center for Business and Public Policy. He is an economist with expertise in industrial organization and public policy, and his research focuses on competition, regulation, telecommunications, the economics of digitization, and technology policy. He was the economics director for the FCC's National Broadband Plan and has been a lecturer in Stanford University’s public policy program, director of communications policy studies and senior fellow at the Progress & Freedom Foundation, a senior fellow at the AEI – Brookings Joint Center for Regulatory Studies and a resident scholar at the American Enterprise Institute, an economist at The World Bank, a scholar at the Stanford Institute for Economic Policy Research, and a staff economist at the U.S. President’s Council of Economic Advisers. He holds a PhD in economics from Stanford University.