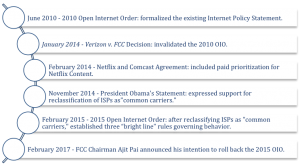

The net neutrality conversation has seen several twists and turns since the FCC’s non-binding “Internet Policy Statement” of the early 2000s. The first iteration of net neutrality regulations was overturned in court. The 2015 Open Internet Order (2015 OIO), which included prohibitions on blocking or throttling content and paid prioritization, were ushered in amidst both cheers and sneers. Most recently, a new FCC has begun the process of rolling back the 2015 OIO.

The debate will continue, in part, because decisions are based on forecasts of what will happen – from an economic perspective, a competition perspective, and an innovation perspective. In his piece “The FCC’s Net Neutrality Decision and Stock Prices,” Bob Crandall conducts a series of event studies to explore how investors view the effects of the rules on the firms most likely to be affected.

This post is the eighth in a series featuring the contents of a recent special issue of the Review of Industrial Organization, organized by the Technology Policy Institute and the University of Pennsylvania’s Center for Technology, Innovation, and Competition.

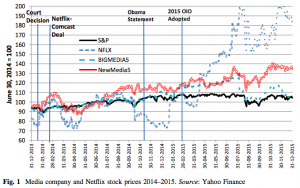

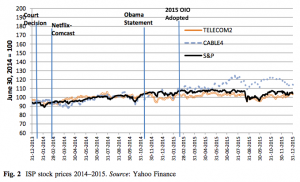

Crandall tracks daily equity prices to measure how investors believe the net neutrality regulations will affect Internet service providers (ISPs) and new and traditional media companies (edge companies, or ECs). Specifically, he examines changes in equity prices of 27 publicly traded companies for periods surrounding a few key dates between 2013 and 2015. The collective market value of the companies, including the likes of Netflix, Comcast, AT&T, and Apple, is upwards of $2 trillion in market value, which underscores the scale of potential economic impact of net neutrality regulations.

Evolution of Net Neutrality Regulations

In principle, by restricting who and how ISPs can charge, net neutrality regulations effectively increase costs to ISPs and reduce costs to edge companies. Therefore, we expect EC stocks to increase in response to events that signaled a shift toward net neutrality regulation, and ISP stocks to decrease in response. We expect the opposite effects in response to events that signaled a shift away from net neutrality regulation.

Generally speaking, Crandall finds only small changes in equity prices around these events[1]. The Verizon v. FCC decision and the 2015 OIO yielded only mild short-term effects in expected directions for most companies[2] [3]. AT&T and Verizon experienced price decreases in the wake of the Netflix-Comcast agreement, but this effect did not extend to smaller cable companies. Interestingly, President Obama’s statement of support for Title II regulation of ISPs yielded large, statistically significant decreases in the prices of Comcast, Time Warner Cable, and Charter equities, but no corresponding increase in EC equities’ prices.

Overall, Crandall’s analysis identified a limited market response to net neutrality, suggesting that investors did not expect net neutrality regulations to effect significant change in the market. In addition, the small changes in EC equities suggest that investors also believed that net neutrality regulations might not be the boon to EC growth and success that net neutrality proponents expect it to be.

This result is particularly notable given the fervor that has developed around this issue. As this post is being written, the FCC has received 18 million comments on the 2015 OIO and the potential rollback, which are themselves sparking debate. Exactly how many comments are “fake” is unknown, but their existence speaks to the passion of opponents and proponents alike. Both sides argue that regulations or lack thereof will have dire consequences. Crandall’s analysis suggests that the reality may be far more modest.

[1] Figures 1 and 2 in this post have been altered to include the date of adoption of the 2015 OIO. Original versions of Figures 1 and 2 are included in the original paper (561). These figures reflect the equity price fluctuations of the media and ISP industries at large rather than fluctuations of the prices of specific companies’ equities.

[2] The author notes that AOL equities experienced a large, statistically significant price increase, but that it was likely due to company-specific news unrelated to net neutrality.

[3] Both Charter and Disney experienced price increases around this event, likely due to news unrelated to net neutrality.

Wallis. G Romzek is a 2017 Google Policy Fellow and Research Associate at the Technology Policy Institute. Romzek is completing her Ph.D. in Public Administration and Policy at American University. She currently holds an MPP from American University, an MBA from the University of Massachusetts, Amherst, and a BA in Mathematics from Bryn Mawr College. Romzek’s research interests lie at the intersection of innovation and social and economic policy, particularly factors that shape adoption of emerging technologies and issues of privacy, data access, and storage.

Scott Wallsten is President and Senior Fellow at the Technology Policy Institute and also a senior fellow at the Georgetown Center for Business and Public Policy. He is an economist with expertise in industrial organization and public policy, and his research focuses on competition, regulation, telecommunications, the economics of digitization, and technology policy. He was the economics director for the FCC's National Broadband Plan and has been a lecturer in Stanford University’s public policy program, director of communications policy studies and senior fellow at the Progress & Freedom Foundation, a senior fellow at the AEI – Brookings Joint Center for Regulatory Studies and a resident scholar at the American Enterprise Institute, an economist at The World Bank, a scholar at the Stanford Institute for Economic Policy Research, and a staff economist at the U.S. President’s Council of Economic Advisers. He holds a PhD in economics from Stanford University.