The FCC recently asked for comments on a proposal to raise money for universal service obligations by taxing broadband connections. Let’s set aside, for the moment, the question of whether the universal service program has worked (it hasn’t), whether it is efficient (it isn’t), and whether the reforms will actually improve it (they won’t). Instead, let’s focus on the specific question of whether taxing broadband is the best way to raise money for any given program telecommunications policymakers want to fund.

The answer, in typical economist fashion, is that it depends.

A tax is generally evaluated on two criteria: efficiency and equity. The more “deadweight loss” the tax causes, the more inefficient it is. Deadweight loss results from people changing their behavior in response to the tax and, in principle, can be calculated as a welfare loss.

Closely related to efficiency is how the tax affects policy goals. This question is particularly relevant here because the service being taxed is precisely the service the tax is also suppose to support, making it possible that the tax itself could undo any benefits of the spending it funds.

Equity—in general, how much people of different income levels pay—is simple in concept but difficult in practice since it is not possible to say what the “right” share of the tax any given group should pay.

Perhaps surprisingly to some, a broadband tax may actually be efficient relative to some other options, including income taxes (i.e., coming from general revenues). Historically, universal service funds were raised by taxes on long distance service, which is highly price sensitive, making the tax quite inefficient.

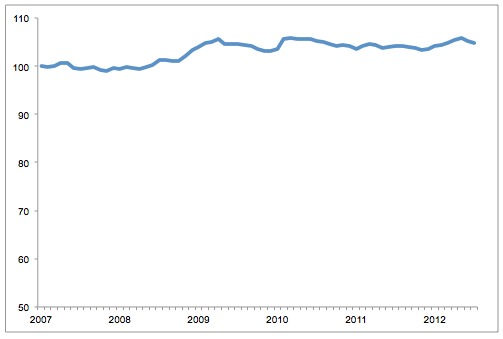

By contrast, for the typical household, fixed (and, increasingly, mobile) broadband has likely become quite inelastic. In 2010, one study estimated that the typical household was willing to pay about $80 per month for “fast” broadband service, while the median monthly price for that service was about $40. Since then, the number of applications and available online services has increased, meaning that consumer willingness to pay has presumably also increased, while according to the Bureau of Labor Statistics broadband prices have remained about the same.

Consumer Price Index, Internet Services and Electronic Information Providers

Source: Bureau of Labor Statistics, Series ID CUUR0000SEEE03, adjusted so January 2007=100

While no recent study has specifically evaluated price elasticity, the large gap between prices and willingness to pay suggests that a tax of any size likely to be considered might not be hugely inefficient overall.

The problem is that even if the tax does not affect subscription decisions by most people, it can still affect precisely the population policymakers want to help. Even though only 10 percent of people who do not have broadband cite price as the barrier, there is some lower price at which people will subscribe. A tax effectively increases the price consumers pay, meaning that it puts people at that margin—people who may be on the verge of subscribing—that much further away from deciding broadband is worthwhile. Similarly, people on the other side of that margin—those who believe broadband is worthwhile, but just barely—will either cancel their subscriptions or subscribe to less robust offerings.

To be sure, people who would be eligible for low-income support would probably receive more in subsidies than they pay in taxes, but this is an absurdly inefficient way to connect more people. As one astute observer noted, it is not merely like trying to fill a leaky bucket, but perhaps more like trying to fill that bucket upside-down through the holes.[1]

Higher prices for everyone highlights the equity problem. A connection tax is the same for everyone regardless of income, making the tax regressive. The tax becomes even more regressive because much of the payments go to rural residents regardless of their income while everyone pays regardless of their income, meaning the tax includes a transfer from the urban poor to the rural rich.

Even without an income test, methods exist to mitigate the equity problem. Unfortunately, the methods the FCC proposes are likely to undermine other policy goals. In particular, the FCC asks about the effects of taxing by tier of service, presumably with higher tiers of service paying more (paragraph 249). The FCC does not specifically mention equity in its discussion, but if higher income people are more likely to have faster connections then it would help mitigate equity issues.

This tiered tax approach is commonly used for other services, including electricity and water, where a low tier of use is taxed at a low rate, and higher usage rates are taxed incrementally more. Therefore, in the case of water, for example, a family that uses water only for cooking and cleaning will pay a lower tax rate than a family that also waters its lawn and fills a swimming pool. And while it is not a perfect measure of income, in general wealthier people are more likely to have big lawns and pools.

The problem with this approach in broadband is that while willingness to pay for “fast” broadband is relatively high, most people are not yet willing to pay much more at all for “very fast” broadband. Thus, taxing higher tiers of service at a higher price, while more equitable, may lead to other efficiency problems if it reduces demand for higher tiers of service.

So what’s the solution?

The FCC should decide which objectives are the most important: efficiency, equity, or other policy objectives such as inducing more people to subscribe or upgrade their speeds, and then design the tax system that best achieves that goal. Then it should compare this “best” tax to the outcome if the system were simply funded from general revenues and compare which of those would lead to a better outcome.

But no tax is worthwhile if the program it supports is itself inefficient and inequitable. The real solution is to dramatically reduce spending on ineffective universal service programs in order to minimize the amount of money needed to fund them. Unfortunately, the reforms appear to do just the opposite. In 2011, the high cost fund spent $4.03 billion and had been projected to decrease even further. The reforms, however, specified that spending should not fall below $4.5 billion (see paragraph 560 of the order), meaning that the first real effect of the reforms was to increase spending by a half billion dollars. And, as the GAO noted, the FCC “has not addressed its inability to determine the effect of the fund and lacks a specific data-analysis plan for carrier data it will collect” and “lacks a mechanism to link carrier rates and revenues with support payments.”

The right reforms include integrating true, third-party, evaluation mechanisms into the program and, given the vast evidence of inefficiency and ineffectiveness, a future path of steady and significant budget cuts. Those changes combined with an efficient tax-collection method, might yield a program that efficiently targets those truly in need.

[1] This excellent analogy comes from Greg Rosston via personal communications.

Scott Wallsten is President and Senior Fellow at the Technology Policy Institute and also a senior fellow at the Georgetown Center for Business and Public Policy. He is an economist with expertise in industrial organization and public policy, and his research focuses on competition, regulation, telecommunications, the economics of digitization, and technology policy. He was the economics director for the FCC's National Broadband Plan and has been a lecturer in Stanford University’s public policy program, director of communications policy studies and senior fellow at the Progress & Freedom Foundation, a senior fellow at the AEI – Brookings Joint Center for Regulatory Studies and a resident scholar at the American Enterprise Institute, an economist at The World Bank, a scholar at the Stanford Institute for Economic Policy Research, and a staff economist at the U.S. President’s Council of Economic Advisers. He holds a PhD in economics from Stanford University.