In this edition of the Research Roundup we highlight a paper by Julie Holland Mortimer and Chris Nosko of Harvard and Alan Sorensen of Stanford GSB that analyzes music file-sharing as it relates to a well-known off-line complement: concert performances. The authors observe that

“Redistribution of the digital good [music downloads] may increase demand for the complementary good [concert tickets], partially offsetting the losses due to illegal redistribution of the digital good. The implication… is that public policy aimed at promoting innovation should not ignore the impact of an innovation on goods or assets that are complementary to it.” (p 2)

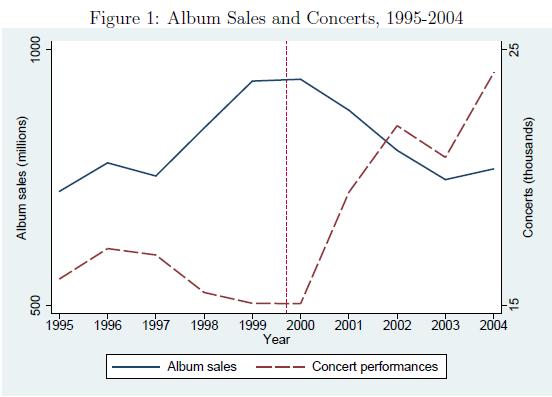

The team undertakes to investigate such a relationship in the recent collapse of recorded music sales and concurrent boom in the demand for live music, depicted in their Figure 1, which is reproduced below.

Their study concludes that

“sales of recorded music declined precipitously with the entry of Napster and large-scale file-sharing. While file-sharing may have substantially displaced album sales, it also facilitated a broader distribution of music, which appears to have expanded awareness of smaller artists and increased demand for their live concert performances. Concert revenues for large artists, however, appear to have been largely unaffected by file-sharing.” (p 19)

These conclusions may be somewhat shaky. For example, the analysis employs little data on actual file-sharing activity (except in one ancillary point of analysis); Mortimer, Nosko, and Sorensen instead estimate the effect of file-sharing through regression with a “Napster” indicator marking whether observations are from “years following the entry of Napster (i.e., 2000 to 2002)” (p 15). This analysis is odd in that the authors themselves warn “time trends alone cannot establish any causal link” (p 10) , and since they do not identify and account for fixed effects (other than the intercept). Their attempt to estimate results with an eye for variation in broadband penetration is promising; unfortunately the data are too coarse for the tests to yield meaningful results.

In spite of any shortcomings, the work is a commendable attempt at understanding the early period of a trend that is often discussed but rarely studied. Still, for right policymaking we should require clearer conclusions.

(Click through to the full post to see the abstract and link for this paper and others in the Roundup.)

Privacy

Catherine Tucker

This paper investigates how internet users’ perception of control over their personal information affects how likely they are to click on online advertising. The paper uses data from a randomized field experiment that examined the relative effectiveness of personalizing ad copy to mesh with existing personal information on a social networking website. The website gave users more control over their personally identifiable information in the middle of the field test. The website did not change how advertisers used anonymous data to target ads. After this policy change, users were twice as likely to click on personalized ads. There was no comparable change in the effectiveness of ads that did not signal that they used private information when targeting. The increase in effectiveness was larger for ads that used less commonly available private information to personalize their message. This suggests that giving users the perception of more control over their private information can be an effective strategy for advertising-supported websites.

Curtis R. Taylor, Vincent Conitzer, Liad Wagman

When a firm is able to recognize its previous customers, it may use information about their purchase histories to price discriminate. We analyze a model with a monopolist and a continuum of heterogeneous consumers, where consumers are able to maintain their anonymity and avoid being identified as past customers, possibly at an (exogenous) cost. When consumers can costlessly maintain their anonymity, they all individually choose to do so, which paradoxically results in the highest profit for the firm. Increasing the cost of anonymity can benefit consumers, but only up to a point, after which the effect is reversed.

Toby Stevens, John Elliott, Anssi Hoikkanen, Ioannis Maghiros, Wainer Lusoli

Authenticating onto systems, connecting to mobile networks and providing identity data to access services is common ground for most EU citizens, however what is disruptive is that digital technologies fundamentally alter and upset the ways identity is managed, by people, companies and governments. Technological progress in cryptography, identity systems design, smart card design and mobile phone authentication have been developed as a convenient and reliable answer to the need for authentication. Yet, these advances are not sufficient to satisfy the needs across people’s many spheres of activity: work, leisure, health, social activities nor have they been used to enable cross-border service implementation in the Single Digital Market, or to ensure trust in cross border eCommerce. The study findings assert that the potentially great added value of eID technologies in enabling the Digital Economy has not yet been fulfilled, and fresh efforts are needed to build identification and authentication systems that people can live with, trust and use. The study finds that usability, minimum disclosure and portability, essential features of future systems, are at the margin of the market and cross-country, cross-sector eID systems for business and public service are only in their infancy. This report joins up the dots, and provides significant exploratory evidence of the potential of eID for the Single Digital Market. A clear understanding of this market is crucial for policy action on identification and authentication, eSignature and interoperability.

Competition and Antitrust

Robert Seamans, Feng Zhu

Theories of multi-sided markets suggest that a platform’s pricing strategies on different sides of the market are closely linked, and in particular, an increase in competition on one side may lead to an increase in price on other sides. We empirically examine platforms’ pricing strategies by exploiting the gradual expansion of Craigslist, a website providing classified ads services, into local newspaper markets. We adopt a differences in-differences approach by comparing the pricing strategies of local newspapers for which classified ads are likely to be a significant portion of their revenue to others before and after Craigslist’s entry. We find that these newspapers drop their classified ad rates significantly more after Craigslist’s entry. We also find that the impact of the entry of Craigslist propagates to other sides of the newspaper market. These newspapers increase their subscription rates relative to others, and consequently, their circulation also drops more. Finally, lower circulation also leads to lower display ad rates for these newspapers. Our study helps build an understanding of how incumbent media platforms respond to technologically disruptive entrants in multi-sided markets.

Net Neutrality

Jan Kraemer, Lukas Wiewiorra

We consider a two-sided market model with a monopolistic Internet Service Provider (ISP), network congestion sensitive content providers (CPs), and Internet customers in order to study the impact of Quality- of-Service (QoS) tiering on service innovation, broadband investments, and welfare in comparison to network neutrality. We find that QoS tiering is the more efficient regime in the short-run. However it does not promote entry by new, congestion sensitive CPs, because the ISP can expropriate much of the CPs’ surplus. In the long-run, QoS tiering may lead to more or less broadband capacity and welfare, depending on the competition-elasticity of CPs’ revenues.

Entrepreneurship

James A. Brander, Qianqian Du, Thomas F. Hellmann

This paper examines the impact of government-sponsored venture capitalists (GVCs) on the success of enterprises. Using international enterprise-level data, we identify a surprising non-monotonicity in the effect of GVC on the likelihood of exit via initial public offerings (IPOs) or third party acquisitions. Enterprises that receive funding from both private venture capitalists (PVCs) and GVCs outperform benchmark enterprises financed purely by private venture capitalists if only a moderate fraction of funding comes from GVCs. However, enterprises underperform if a large fraction of funding comes from GVCs. Instrumental variable regressions suggest that endogeneity in the form of unobservable selection effects cannot account for these effects of GVC financing. The underperformance result appears to be largely driven by investments made in times when private venture capital is abundant. The outperformance result applies only to venture capital firms that are supported but not owned outright by governments.

Darian M. Ibrahim

This Article examines a third exit option in venture capital to supplement IPOs and trade sales: secondary markets for the sale of individual ownership interests in start-ups and venture capital (VC) funds. While investors can readily buy shares in publicly-traded companies, until recently they have been unable to own a piece of private start-ups like Facebook or Twitter without working there or investing in exclusive VC funds. Now that venture capital has become a $400 billion worldwide asset class, however, start-up stock and limited partnership interests in VC funds have begun trading in private secondary markets. These secondary markets offer initial investors a new path to liquidity, offer buyers access to a previously untapped class of assets, and produce governance benefits for traded firms. The realization of these benefits in venture capital should lead to a net increase in the total amount of entrepreneurial activity. Given the surplus that entrepreneurial activity produces for society, VC secondary markets should be studied by academics and encouraged by policy makers. This Article is the first to study VC secondary markets and the issues they implicate in law and economics analysis. The Article examines VC secondary markets in their present state and contemplates their further development.

Economics of the Internet

Julie Holland Mortimer, Chris Nosko, Alan Sorensen

Changes in technologies for reproducing and redistributing digital goods (e.g., music, movies, software, books) have dramatically affected profitability of these goods, and raised concerns for future development of socially valuable digital products. However, broader illegitimate distribution of digital goods may have offsetting demand implications for legitimate sales of complementary non-digital products. We examine the negative impact of file-sharing on recorded music sales and offsetting implications for live concert performances. We find that file-sharing reduces album sales but increases live performance revenues for small artists, perhaps through increased awareness. The impact on live performance revenues for large, well-known artists is negligible.

V. Brian Viard, Nicholas Economides

We test the effect of content availability on Internet adoption across countries. Controlling for the endogeneity of content with respect to the installed base of Internet users and a host of demographic, economic and infrastructure factors, content has a statistically and economically significant effect. Since content is more easily and quickly altered than these other factors, our results suggest that policies promoting content creation will positively affect Internet diffusion even in the short run. Our results also suggest that, given its ubiquity, Internet content is a useful tool to affect social change across countries. Content has a greater effect on adoption in countries with more disparate languages, consistent with its use to overcome linguistic isolation, and in countries with international Internet gateways, suggesting the importance of infrastructure to deliver content.

Susan Athey, Glenn Ellison

“This paper considers a dynamic model of the evolution of open source software projects, focusing on the evolution of quality, contributing programmers, and users who contribute customer support to other users. Programmers who have used open source software are motivated by reciprocal altruism to publish their own improvements. The evolution of the open-source project depends on the form of the altruistic benefits: in a base case the project grows to a steady-state size from any initial condition; whereas adding a need for customer support makes zero-quality a locally absorbing state. We also analyze competition by commercial firms with OSS projects. Optimal pricing policies again vary: in some cases the commercial firm will set low prices when the open-source project is small; in other cases it mostly waits until the open-source project has matured.”

Energy

Wolfgang Ketter, John Collins, Carsten A. Block

Sustainable energy systems of the future will need more than efficient, clean, low-cost, renewable energy sources; they will also need efficient price signals that motivate sustainable energy consumption as well as a better real-time alignment of energy demand and supply.